2021 taxes calculator

Tax Calculator 2021 Tax Returns Refunds During 2022. Dont include points mortgage insurance premiums or any interest paid in 2021 that is for a year after 2021.

How To Calculate Income Tax In Excel

How Income Taxes Are Calculated.

. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes. However income tax calculator 2020 takes into account the various deductionsexemptions under the Income Tax Act of 1961. For Age between 60 80 years 5 slab is for income between Rs.

Calculate your term plan premium online with Max Life Term Plan calculator. However now or in early 2022 we suggest you reduce your per paycheck tax withholding. The state charges different taxes on specific items.

Employees are often issued Form 16 from their respective employers showcasing total salary and taxes deducted thereon. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Manitoba uses a portioned assessment system which was introduced in 1990 to distribute the taxes since market values increase at different rates for each class of property.

500000 under Old Slab Rates. Fill-in your email below to receive a PDF with detailed results. The median property tax homeowners in New Hampshire pay is 5768.

Income Tax Calculator Alberta 2021 Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Find out the total cost of employment of local and foreign staff. You can use the Income Tax Calculator to calculate your tax liability in India for the financial year.

Interim property taxes or property taxes for the first half of the year. How much to hire your staff in China. TAX DAY NOW MAY 17th - There are -473 days left until taxes are due.

Keep in mind that mortgage rates have risen since 2021 and higher mortgage rates lead to higher monthly payments on average. Select your Age bracket as 60-80 years for Senior Citizens and 80 years for Super Senior Citizens and your Residential status for the financial. The calculator estimates property taxes based on averages from tax.

The New Tax Slab Rates are same for all age groups. Income Tax Calculator. ICalculator aims to make calculating your Federal and State taxes and Medicare as.

The gasoline tax of 22 cents per gallon is among the cheapest nationally 42nd. More help before you apply. Thus each class of property will have a different sized portion of their.

Here are the tax brackets for tax years 2021 and 2022 and how you can work out which tax bracket you fit into. You can learn more about how the California income tax compares to other states income taxes by visiting our map of income taxes by state. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505.

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. However it makes up for it with its property taxes as it boasts the fourth-highest property tax rate in the US. Enter the deductions investments health insurance education loan charity etc.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. In terms of median property tax payments New Hampshires property taxes also rank among the top three in the nation. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

They are usually calculated using the assessed value of the property and the property tax rate of a certain region or municipality. Start filing your tax return now. Our calculator provides a detailed cost breakdown including the Individual Income Tax deductions and the employee and employers social security and housing fund contributions.

However do include interest that is for 2021 but was paid in an earlier year. You can probably start with your households adjusted gross income and update it for expected changes. The Federal Income Tax.

Individuals can go through their TDS certificates to determine the taxes already paid. The Advance Tax Calculator will calculate your advance tax liability for each quarter of the financial year under the old and new tax regime. At this point of the year you have already withheld too much in 2021 IRS taxes.

Property Tax Calculator 2021. Rated 48 by 176 users on Verified Reviews. Income Taxes By State.

Home Tax Calculator 2021. WOWA Trusted and Transparent. Term Insurance Plan Calculator.

When you fill out your Form 1040 this year youll have to compare the total amount of advance child tax credit payments that you received in 2021 with the amount of the actual child tax credit. Enter the annual interest rate on the mortgage. Calculate the new term plan premium for age group of 18-60 for male and female and choose your cover for sum assured 25L 50L 75L and 1 Cr.

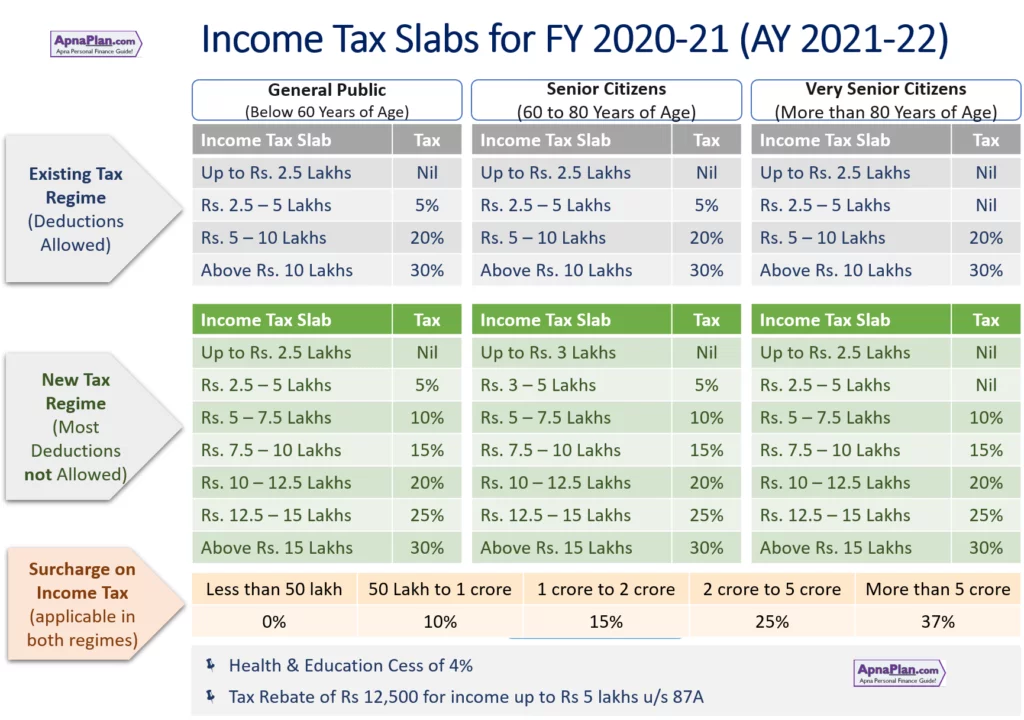

Income Tax Slab Rates for FY 2021-22 FY 2022-23. City of Winnipeg Flag. Your household income location filing status and number of personal exemptions.

How Income Taxes Are Calculated. Province of residence Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Quebec Saskatchewan Yukon. 2022 Income Tax Brackets Taxes Due April 2023.

If the interest rate varied in 2021 use the lowest rate for. Estimated IRS Refund Tax Schedule for 2021 Tax Returns In prior years the IRS issued its refund tax schedule to provide a timeline of when you can expect to receive your tax refund. Your household income location filing status and number of personal exemptions.

Property taxes are levies that governments use as a source of tax revenue. Enter taxes paid during the form of TDSTCS and previous Advance Tax Installments. WOWA Trusted and Transparent.

Meanwhile the cigarette tax of 084 dollars per 20-pack. As a result you should receive a tax refund. Enter the interest paid in 2021.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Select the financial year from FY 2021-22 AY 2022-23 or previous FY 2020-21 AY 2021-22. Savings are based on your income estimate for the year you want coverage not last yearYou may qualify to enroll in or change Marketplace coverage through a new Special Enrollment.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Winnipeg Property Tax Calculator 2021. Estimating your expected household income for 2022.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Ontario Income Tax Calculator Wowa Ca

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Tax Calculator Philippines 2022

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

2021 Tax Calculator Frugal Professor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2021 2022 Income Tax Calculator Canada Wowa Ca

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sales Tax Calculator